Cryptocurrency Wallet Security: Protecting Your Digital Assets

April 8, 2024 | by Winson Yeung

As the digital realm of cryptocurrencies continues to expand, the significance of securing your crypto wallet cannot be overstated. The irreversible nature of blockchain transactions highlights the critical need for robust security measures to protect your digital assets from unauthorized access. In this article, we explore various strategies to fortify your cryptocurrency wallet, ensuring your investments are safeguarded and your transactions remain private and reliable. Here’s how you can enhance the security of your crypto wallet and maintain peace of mind in the volatile world of digital currencies.

Key Takeaways

- Choose reliable and reputable wallets with strong track records to protect your digital assets from cyber threats.

- Safeguard your private keys with robust encryption and consider hardware wallets for an added layer of security.

- Stay informed about the latest security measures and update your wallet software to defend against new vulnerabilities.

- Be vigilant against phishing attempts, avoid public Wi-Fi for transactions, and regularly monitor your wallet activity.

- Back up your wallet data regularly and diversify your cryptocurrency investments to minimize risks and ensure recovery options.

Choosing the Right Wallet for Maximum Security

Assessing Wallet Providers’ Track Record

When I first ventured into the world of cryptocurrencies, I quickly realized that cryptocurrency security is paramount for safeguarding my investments. It’s not just about choosing any wallet; it’s about selecting one with a solid track record. Here’s what I do to ensure I’m making the right choice:

- I look for wallet providers that have been in the market for a while and have a history of robust security measures.

- I check for any past security breaches and how the provider handled them.

- I consider the provider’s transparency regarding their security protocols and their response to the ever-evolving threat landscape.

It’s essential to understand that the safety of my digital assets also depends on my actions. Regularly reviewing transactions and setting up alerts keeps me in control and aware of any potential issues.

Finally, I always remind myself that staying informed is key. I make it a point to keep up with the latest security trends and updates, which equips me with the knowledge needed to protect my assets effectively.

Understanding Wallet Types: Hardware vs. Software

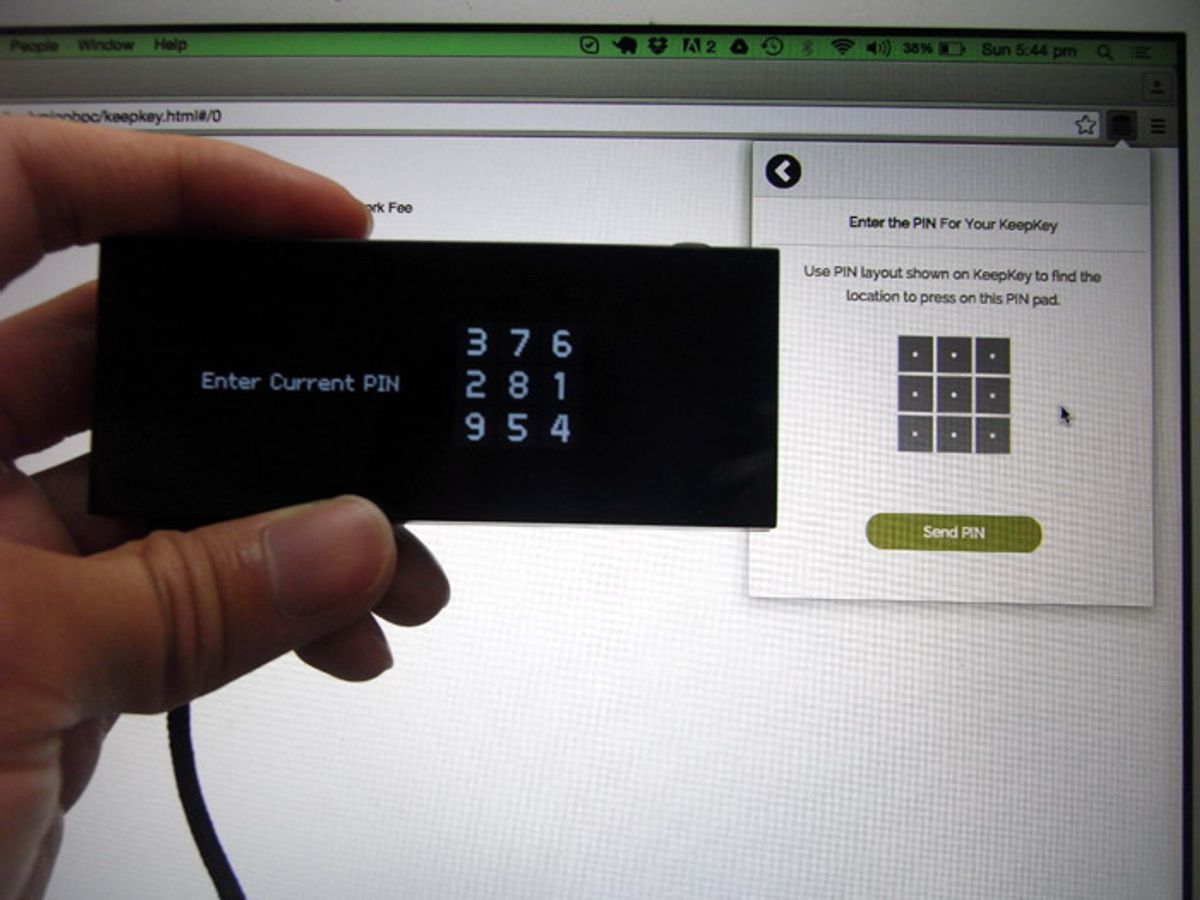

When I delve into the realm of cryptocurrency, I’m faced with a crucial decision: choosing between hardware and software wallets. Hardware wallets, such as the Ledger Nano S, Trezor One, and KeepKey, are tangible devices that store my private keys offline. This physical form of storage provides a robust barrier against online threats, making them ideal for the long-term safeguarding of substantial crypto holdings.

On the other hand, software wallets like Halo Wallet and Exodus are digital applications that offer convenience and easy access across various devices. While they are more susceptible to online risks, their user-friendly nature makes them suitable for everyday transactions.

Both wallet types come with their own set of pros and cons. It’s imperative to weigh these carefully against my personal needs and security requirements.

Here’s a quick comparison to help me decide:

- Hardware Wallets: Best for high security and offline storage; higher cost; requires physical backup.

- Software Wallets: Ideal for frequent access and ease of use; vulnerable to online threats; generally free or low cost.

Diversification is essential for managing risk in cryptocurrency investing. Asset allocation, risk management, and security measures are crucial for long-term success and safeguarding investments.

The Importance of Wallet Reputation and User Reviews

When I’m considering a new cryptocurrency wallet, I always take the time to research its reputation within the community. User reviews and feedback are invaluable resources for gauging the reliability and security of a wallet. It’s not just about the number of stars it has on an app store; I look for detailed accounts of user experiences, especially regarding security features and support responsiveness.

Here’s a simple checklist I follow:

- Research the wallet’s history for any past security incidents.

- Check social media and forums for current user feedback.

- Look for detailed user reviews that go beyond simple ratings.

Remember, a wallet’s reputation is built over time and is often a reflection of its commitment to security and user satisfaction.

I also pay close attention to how a wallet provider responds to issues. A provider that is transparent and quick to address security concerns instills more confidence. After all, in the dynamic world of cryptocurrency, staying informed and choosing a wallet with a solid reputation can make all the difference in protecting my digital assets.

Key Management: Your First Line of Defense

The Critical Role of Private Keys in Wallet Security

I’ve come to realize that the private key is essentially my digital signature in the world of cryptocurrency. Much like the PIN to my debit card or the key to a safety deposit box, it’s a unique identifier that proves ownership and authorizes transactions on the blockchain. It’s imperative to keep this key confidential, as its exposure can lead to the loss of my digital assets.

The safeguarding of private keys is the cornerstone of wallet security. Without proper protection, the door to my digital wealth is left wide open for unauthorized access.

To ensure the security of my private keys, I follow a set of best practices:

- Safeguard Your Private Keys: Store them in a secure, offline environment, such as a hardware wallet.

- Use Strong Encryption Measures: Protect your keys with advanced encryption and security features.

- Regularly Update Security Practices: Stay informed about the latest threats and update your security measures accordingly.

By adhering to these guidelines, I maintain a robust defense against potential intrusions. It’s a continuous process of learning and adapting, but it’s worth the peace of mind it brings.

Best Practices for Storing and Managing Private Keys

When it comes to securing my cryptocurrency, I understand that the private key is akin to the key to a vault; if it falls into the wrong hands, my digital assets are at risk. Therefore, I follow a set of best practices to ensure my private keys are protected at all times.

- Generate Private Keys Securely: I make sure to use a reliable and secure method to generate my private keys, avoiding any online tools that might be compromised.

- Offline Storage (Cold Storage): I store my private keys in an offline environment, such as a hardware wallet or a paper wallet, to shield them from online threats.

- Backup Your Private Keys: I create multiple backups of my private keys and store them in different secure locations to prevent loss due to damage or theft.

- Use Hardware Wallets: For an added layer of security, I utilize hardware wallets which are designed to be tamper-proof and immune to computer viruses.

- Implement Multi-Signature Wallets: To further secure my assets, I use multi-signature wallets which require more than one key to authorize a transaction, adding an extra hurdle for potential thieves.

In my journey with crypto since the early years, I’ve learned that vigilance and proper key management are non-negotiable. I’ve devised my own methods to keep my recovery keys safe, especially while traveling, which has become an integral part of my security protocol.

By adhering to these practices, I can rest assured that my digital assets are as secure as possible. It’s a continuous process of staying informed and adapting to new threats, but it’s a small price to pay for the peace of mind it brings.

Hardware Wallets: An Extra Layer of Security for Your Keys

I’ve come to appreciate the peace of mind that hardware wallets provide. These physical devices, such as the Ledger Nano S or Trezor One, store my private keys offline, shielding them from online vulnerabilities. It’s a comforting thought that even if my computer is compromised, my digital assets remain secure, tucked away in a device that requires my physical presence to access.

The pros of using hardware wallets are numerous. They offer excellent security through offline storage and robust hardware encryption. The user-friendly interfaces make managing my cryptocurrencies a breeze, and I rest easy knowing I’m protected against hacking, malware, and even physical attacks. However, it’s not all sunshine and rainbows; the costs can be steep, and the risk of losing or damaging the device is a constant concern. Here’s a quick rundown:

- Pros:

- Offline storage of private keys

- Hardware encryption

- User-friendly interfaces

- Protection against various threats

- Cons:

- Higher initial costs

- Risk of loss or damage

- Technical knowledge required

It’s essential to back up and store the seed phrase associated with your hardware wallet. This way, if the device is lost or damaged, you won’t lose access to your funds.

Choosing the right cryptocurrency wallet is crucial for balancing security and accessibility. I always weigh my options carefully, considering factors like hot vs. cold wallets, two-factor authentication, encryption, and the provider’s track record. After all, these decisions are the bedrock of safeguarding my digital assets.

Enhancing Security Through Technology

Implementing Strong Encryption Measures

I’ve learned that encryption is my digital vault’s best friend. Using strong encryption to protect my wallet data is a non-negotiable step in safeguarding my digital assets. Whether it’s a hardware, software, or even a paper wallet, robust encryption standards are the shield against unauthorized access.

Here’s a quick rundown of encryption algorithms that are commonly considered strong in the crypto space:

- AES encryption

- RSA

- Elliptic Curve Cryptography

- SHA-256

It’s not just about having encryption; it’s about having the right kind. I make it a point to verify that the encryption methods used by my wallet are up to date and considered secure by industry standards.

Complex passwords are another cornerstone of my security strategy. They’re like a secret handshake that only my wallet and I know. I use a mix of uppercase and lowercase letters, numbers, and special characters—and I never reuse passwords across different platforms. A password manager is a handy tool for keeping track of these complex combinations.

The Necessity of Multi-Factor Authentication

In my journey to secure my digital assets, I’ve learned that multi-factor authentication (MFA) is not just an option; it’s a necessity. By requiring multiple forms of verification, MFA ensures that even if one credential is compromised, unauthorized access to my wallet remains highly unlikely. Here’s why I consider it indispensable:

- Enhanced Security: MFA adds a critical security layer that goes beyond a simple password, making it tougher for cybercriminals to breach my wallet.

- Diverse Verification Methods: It allows for a combination of something I know (like a password), something I have (like a mobile device), and something I am (like a fingerprint).

- Reduced Fraud Risk: With MFA, the risk of fraudulent access is significantly diminished, as attackers must bypass multiple security hurdles.

MFA is a robust defense mechanism that fortifies my wallet against the ever-evolving threats in the digital world. It’s a shield that I, and every crypto enthusiast, should actively employ.

I’ve seen firsthand how MFA can deter even the most persistent intruders. It’s a simple yet powerful tool that provides peace of mind, knowing that my investments are guarded by more than just a password. As the saying goes, ‘the more, the merrier,’ and when it comes to authentication factors, this couldn’t be truer.

Keeping Your Wallet Software Up to Date

I’ve learned that one of the simplest yet most effective steps I can take to secure my digital assets is to keep my wallet software up to date. Developers regularly release updates that patch vulnerabilities and enhance security features. By staying current with these updates, I ensure that I’m not left exposed to the latest threats.

- Regularly check for software updates from the official source.

- Install updates as soon as they become available.

- Enable automatic updates if the option is available.

It’s crucial to understand that an outdated wallet can be a weak link in my security. Without the latest protections, I might as well leave my digital front door unlocked for cybercriminals.

By following these simple steps, I not only protect my own assets but also contribute to the overall security of the blockchain network. It’s a responsibility I take seriously, and I encourage every user to do the same.

The Human Element: Avoiding Common Security Pitfalls

Recognizing and Preventing Phishing Attempts

In my journey with cryptocurrencies, I’ve learned that phishing attempts are a prevalent threat. These deceptive tactics aim to steal sensitive information like login credentials or private keys. To combat this, I always double-check the authenticity of the sender or website. It’s crucial to scrutinize the URL, domain, and email address for any discrepancies.

Exercise caution with offers that seem too good to be true and always verify identities before sharing personal information. This reduces the risk of identity theft and fraud.

Here’s a quick checklist to help you stay safe:

- Conduct thorough research before engaging with crypto ventures.

- Confirm the legitimacy of platforms or individuals.

- Ensure URLs are correct and secure before entering data.

Remember, staying informed and alert is your best defense against these malicious actors.

The Dangers of Public Wi-Fi and How to Navigate Them

When I’m on the go, I’m always tempted to connect to public Wi-Fi to check my crypto wallet. However, I’ve learned that this convenience comes with significant risks. Public networks are often not secure, making them a playground for hackers looking to intercept data. To ensure the safety of my digital assets, I avoid conducting transactions over public Wi-Fi. Instead, I opt for a secure and private internet connection, like my password-protected home network or a trusted mobile data plan.

If I absolutely must use public Wi-Fi, I make it a rule to use a virtual private network (VPN). A VPN encrypts my internet connection, adding an extra layer of security that’s crucial for protecting my sensitive information. Here’s a quick checklist I follow to stay safe:

- Always use a secure connection for transactions.

- If public Wi-Fi is the only option, connect through a reliable VPN.

- Regularly monitor my wallet’s transaction history for any unauthorized activity.

By staying vigilant and employing these simple strategies, I can significantly reduce the risk of falling victim to cyber threats while managing my cryptocurrency investments.

Regular Monitoring: Staying Ahead of Unauthorized Access

I’ve learned that regularly monitoring my wallet transactions is a fundamental step in maintaining the security of my digital assets. By keeping a vigilant eye on the transaction history, I can quickly identify any unauthorized activity. Here’s a simple checklist I follow to ensure I’m on top of my wallet’s security:

- Set up notifications for any transactions or balance changes.

- Conduct frequent reviews of my transaction history for unfamiliar activity.

- Immediately report any suspicious transactions to my wallet provider.

It’s not just about setting up the right tools; it’s about actively engaging with them to detect and deter potential threats.

In the unfortunate event that I do notice something amiss, I have a clear action plan. The first step is to notify the wallet provider, as they may have the means to help recover any compromised assets. This proactive approach to wallet security has become an integral part of my routine, ensuring that I stay one step ahead of potential hackers.

Maintaining Vigilance: Staying Informed and Prepared

The Role of Education in Crypto Wallet Security

I’ve come to realize that education is the cornerstone of crypto wallet security. Knowledge is power, especially when it comes to safeguarding digital assets. By staying informed about the latest security practices and understanding the evolving landscape of threats, I can take proactive steps to protect my investments.

- Recognize Phishing Attempts: Learning to identify and avoid phishing scams is essential.

- Secure Your Private Keys: Understanding the importance of private keys and how to protect them.

- Choose Reliable Wallets: Knowing what to look for in a wallet provider can make all the difference.

- Stay Informed: Keeping up with security trends and updates is non-negotiable.

It’s not just about the tools we use; it’s about how well we understand them and the threats they face. Continuous learning and adaptation are vital in maintaining the security of our crypto wallets.

As I reflect on the importance of education, I’m reminded of a recent article titled ‘How Universities Can Help Encourage Safe Crypto Transactions‘. It highlighted the role educational institutions play in advocating for secure practices and financial literacy. This resonates with me, as I believe that a well-informed community is the best defense against security breaches.

Diversifying Investments to Minimize Risks

In my journey through the volatile landscape of cryptocurrency, I’ve learned that diversifying investments is crucial for mitigating risks. By spreading my assets across various cryptocurrencies, I reduce the impact of market fluctuations on my portfolio. This strategy is akin to not putting all my eggs in one basket, ensuring that a downturn in one asset doesn’t spell disaster for my entire investment.

Diversification isn’t just about different coins; it’s about different types of assets within the crypto space. I balance my holdings between established coins, emerging altcoins, and even tokens representing different sectors or technologies.

Here’s a simple breakdown of how I approach diversification:

- Established Coins: These are the cryptocurrencies with a proven track record, like Bitcoin and Ethereum. They form the foundation of my portfolio.

- Emerging Altcoins: These coins may offer higher potential returns but come with increased risk. I allocate a smaller portion of my portfolio to them.

- Token Sectors: I also invest in tokens from various sectors such as DeFi, NFTs, and more, to capitalize on specific industry growth.

The Importance of Regular Backups and Data Recovery Plans

I’ve learned that in the world of cryptocurrency, the adage ‘better safe than sorry’ couldn’t be more pertinent. Regular backups are essential for safeguarding my digital assets against unexpected events like hardware malfunctions or cyber theft. By routinely updating my backup copies, I ensure that my wallet’s data remains recoverable, even in the face of adversity.

The peace of mind that comes with knowing my investments are secure is invaluable. A robust data recovery plan is not just a safety net; it’s a critical component of my overall security strategy.

To illustrate the importance, let’s consider the options available for data recovery plans. A 2-year plan might cost as little as $4.99, while a 3-year plan could be slightly higher at $5.99. These small investments can potentially save me from catastrophic losses.

- Backup Your Data: Store backups in multiple secure locations.

- Update Regularly: Keep your backups current to reflect the latest data.

- Choose the Right Plan: Consider the duration and cost of recovery plans.

- Test Your Backups: Ensure that you can recover your data from the backups you’ve created.

Conclusion

In summary, the security of cryptocurrency wallets is a critical aspect of managing digital assets. Users must exercise due diligence by choosing reliable wallets, securing private keys, and staying informed about the latest security measures. The irreversible nature of blockchain transactions amplifies the importance of wallet security, making it essential for users to take an active role in protecting their investments. By employing strong encryption, enabling multi-factor authentication, and maintaining regular software updates, individuals can significantly reduce the risk of unauthorized access and potential losses. Ultimately, the responsibility for safeguarding crypto assets rests with both the wallet providers and the users themselves. As the crypto landscape continues to evolve, staying vigilant and proactive in wallet security will help ensure a secure and successful experience in the world of digital currencies.

Frequently Asked Questions

How do I choose a reliable cryptocurrency wallet?

Select a trusted crypto wallet with a proven track record of security and reliability. Look for wallets that are well-reviewed by users and have a history of safeguarding assets against unauthorized access.

What are the best practices for securing my private keys?

Safeguard your private keys by storing them offline in a hardware wallet or secure physical location. Avoid sharing them online and consider using multi-signature technology for added security.

Why is staying informed important for crypto wallet security?

Keeping abreast of the latest security trends and updates equips you with the knowledge needed to protect your wallet against emerging threats and to follow best practices in wallet security.

What should I do to protect my wallet from phishing attempts?

Be vigilant in recognizing phishing attempts by carefully inspecting messages and emails for authenticity. Avoid clicking on suspicious links and always verify the legitimacy of requests for your private information.

Why is it important to regularly update my wallet software?

Regularly updating your wallet software and antivirus programs protects against emerging threats and vulnerabilities. Updates often include security enhancements and patches for known issues.

What steps should I take to ensure my cryptocurrency investments are diversified?

Spread your investments across different cryptocurrencies and assets to reduce the impact of market fluctuations and minimize risk exposure. Diversification is a key strategy in managing investment risk.

RELATED POSTS

View all