Understanding The Risks And Rewards Of Cryptocurrency ICOs

March 29, 2024 | by Winson Yeung

Cryptocurrency Initial Coin Offerings (ICOs) offer a unique blend of risks and rewards for investors willing to venture into the nascent world of digital assets. These events provide early access to potentially groundbreaking projects, but they also come with significant challenges such as market volatility and regulatory uncertainty. Understanding the intricacies of ICOs is crucial for anyone looking to participate in this high-stakes investment opportunity.

Key Takeaways

- Cryptocurrency ICOs present a high-risk, high-reward investment landscape, often offering early access to innovative platforms but requiring careful navigation of market volatility and potential scams.

- Investor due diligence is paramount, involving thorough research into the ICO’s project, team, technology, and market potential, as well as staying informed about the latest news and updates.

- Diversification is a key strategy in managing the risks of ICO investing, spreading investments across various projects and sectors to mitigate potential losses.

- Understanding the ICO ecosystem is essential, including the role of community, the impact of regulatory changes, and the influence of technological innovations on the success of ICOs.

- Successful ICO investment hinges on assessing the credibility of the ICO platform and team, taking advantage of strategic presale opportunities, and maintaining vigilant security measures for one’s investment.

Early Bird Advantages in Cryptocurrency ICOs

Unlocking Potential Through Early Access

I’ve come to realize that early access in the world of cryptocurrency ICOs is akin to being handed a key to a treasure chest. Early access to burgeoning blockchain projects through Pre-ICOs enables investors to delve into innovative concepts and potentially disruptive technologies, often before the general public even catches wind of them. This head start can be incredibly advantageous, as it allows for investment at a stage where the token prices are at their most attractive.

The excitement of being part of something from its inception is palpable. Investing in crypto ICOs at the presale stage is akin to finding a hidden gem. The tokens acquired here are not just digital assets; they represent a stake in the project’s future. It’s a chance to support and grow with the project, potentially reaping the rewards as it matures.

In conclusion, crypto presales represent a gateway to early investment opportunities, offering the dual benefits of lower entry costs and the potential for significant returns.

However, it’s crucial to approach these opportunities with a blend of optimism and prudence. The key here? Early participation. Those getting in on the ground floor can snag the best deals and highest APYs. As the stages progress, prices inch up, making now the time to act. Remember, investing in ICOs is not for the faint-hearted. It requires a balance of enthusiasm for the project’s vision and a cautious approach to risk management.

High Stakes, High Rewards

As I’ve ventured deeper into the world of cryptocurrency ICOs, I’ve been captivated by the potential for high returns. The stories of early investors in projects like Ethereum or Ripple are legendary, and the possibility of discovering the next big thing is tantalizing. These early-stage investments can significantly boost a portfolio, offering not just financial gains but also diversification.

However, with the promise of reward comes the risk. The volatility of the crypto market is well-known, and the security concerns and regulatory uncertainty can’t be ignored. To succeed, it’s crucial to conduct thorough research, stay on top of market trends, and employ sound risk management strategies.

The balance between risk and reward is delicate, and as an investor, I must carefully consider each opportunity. It’s about finding that sweet spot where the potential gains justify the risks involved.

For example, staking rewards in ICOs present an attractive opportunity for early investors. By committing funds early, you can earn additional tokens, which could increase in value as the project matures. Here’s a quick look at the potential of staking rewards:

| ETH, USDT, Card | Listing Price |

|---|---|

| $0.30 | Staking Reward |

In conclusion, while the stakes are indeed high, the rewards can be equally compelling. It’s a game of strategic decisions and calculated risks, and for those who play it well, the world of cryptocurrency ICOs can be incredibly rewarding.

Navigating the Risks

As I delve deeper into the world of cryptocurrency ICOs, I’ve come to realize that patience and education are key to safely navigating this space. The risks are manifold; from the volatility that can see fortunes made or lost in a heartbeat, to the ever-present danger of scams that prey on the uninformed.

To stay ahead, I’ve adopted a guide to safely investing in cryptocurrency: understand risks, research thoroughly, secure my investments, diversify my portfolio, avoid scams, assess volatility, and choose my ICOs wisely.

Here’s a quick checklist I always run through before considering an ICO investment:

- Conduct extensive research on the project and its team.

- Evaluate the ICO’s whitepaper for clarity and feasibility.

- Assess the regulatory environment and compliance.

- Implement robust security measures for my digital assets.

- Keep abreast of market news and updates to inform my decisions.

By adhering to these steps, I aim to mitigate the risks and position myself to capitalize on the potential rewards that ICOs offer.

The Perils and Promises of ICO Investing

Market Volatility and Investor Exposure

In my journey through the cryptocurrency landscape, I’ve come to understand that market volatility is a constant companion. One day, you’re watching your investments soar; the next, you’re bracing for a steep decline. This rollercoaster is driven by a myriad of factors, from market speculation to macroeconomic events, and it’s a reality that every crypto investor must face.

The key to navigating this tumultuous environment is not just to survive the swings, but to thrive amidst them. It’s about finding balance and employing strategies that align with your investment goals.

Here’s a snapshot of what this volatility can look like:

- High volatility: Crypto assets can experience large swings in value, sometimes within hours.

- Regulatory changes: Governmental policies can significantly affect market sentiment and adoption.

- Security concerns: The ever-present risk of hacks and scams.

- Knowledge barriers: Staying informed is crucial, yet challenging given the complexity of the market.

Crypto market volatility, regulatory uncertainty, security concerns, and knowledge barriers are key challenges. Long-term investment strategy, risk management, diversification, and patience are crucial for success in cryptocurrency investing.

Due Diligence: The Investor’s Shield

Before I dive headfirst into the alluring world of ICOs, I’ve learned that due diligence is my best defense. I meticulously pore over the project’s whitepaper, examining every detail from the technology to the tokenomics. It’s not just about the buzzwords like ‘staking rewards’ or ‘play-to-earn’; it’s about understanding the substance behind the hype.

In my experience, the key to unlocking a successful ICO investment lies in the ability to sift through the noise and identify the true innovators. This means going beyond the herd mentality and FOMO, and instead, focusing on the project’s fundamentals.

I also make it a point to scrutinize the team’s background. Are they veterans in the crypto space or just riding the wave? I look for a clear roadmap, transparent team profiles, and verifiable partnerships. These are the hallmarks of a project that’s not just promising the moon but has a plan to get there. Additionally, I stay active in communities and forums. The shared experiences from other investors are often the beacons that guide me away from potential scams.

Here’s a quick checklist I follow to ensure I’m conducting thorough due diligence:

- Research the team’s credibility and experience

- Analyze the whitepaper for feasibility and innovation

- Check the project’s community engagement and social media presence

- Investigate any legal issues or past failures associated with the team

- Verify the security measures in place, such as 2FA and cold storage of assets

Future Outlook: Trends and Predictions

As we look towards the future, the ICO landscape appears to be teeming with both innovation and caution. The Best ICOs to Invest in 2024 have been a hot topic, with names like Green Bitcoin and Bitcoin Minetrix stirring considerable interest among investors. The promise of high returns continues to draw attention, but it’s the underlying technology and business models that will likely dictate long-term success.

With careful consideration and a bit of due diligence, there are potentially profitable opportunities for the savvy investor.

The market’s evolution suggests a trend towards more mature and regulatory-compliant ICOs. This shift is a response to past market excesses and a growing demand for transparency and security in investments. Here’s a quick look at some of the key trends that are shaping the ICO world:

- Increased emphasis on due diligence and investor education

- Greater regulatory oversight and compliance requirements

- Technological advancements enhancing security and trust

- A focus on sustainable and socially responsible crypto projects

Here’s to discovering the gems of 2024 and beyond, as we navigate this dynamic and ever-changing ecosystem.

Key Strategies for ICO Participation

Research: The Cornerstone of ICO Investment

As I’ve navigated the complex world of ICOs, I’ve learned that due diligence is key. It’s not just about the allure of quick gains; it’s about understanding what you’re investing in. I start by diving deep into the project’s whitepaper, examining the team’s background, and keeping a pulse on the latest Bitcoin news. Tools like Telegram channels have become invaluable for real-time insights and updates.

Beyond the hype and the fear of missing out, it’s crucial to approach each ICO with a critical eye. I’ve seen many investors get caught up in the herd mentality, only to regret it later. To avoid such pitfalls, I’ve compiled a simple checklist that I follow before committing my funds:

- Review the project’s vision and mission.

- Assess the team’s experience and track record.

- Analyze the tokenomics and distribution strategy.

- Monitor community feedback and sentiment.

Embracing the future of ICO investing requires confidence, curiosity, and a willingness to learn and adapt. It’s a journey of continuous education, where staying informed is not just a recommendation—it’s a necessity.

In summary, the ICO landscape is fraught with both peril and promise. By conducting thorough research and practicing due diligence, I position myself to better navigate these waters and potentially capitalize on promising opportunities. Remember, an informed investor is a smart investor.

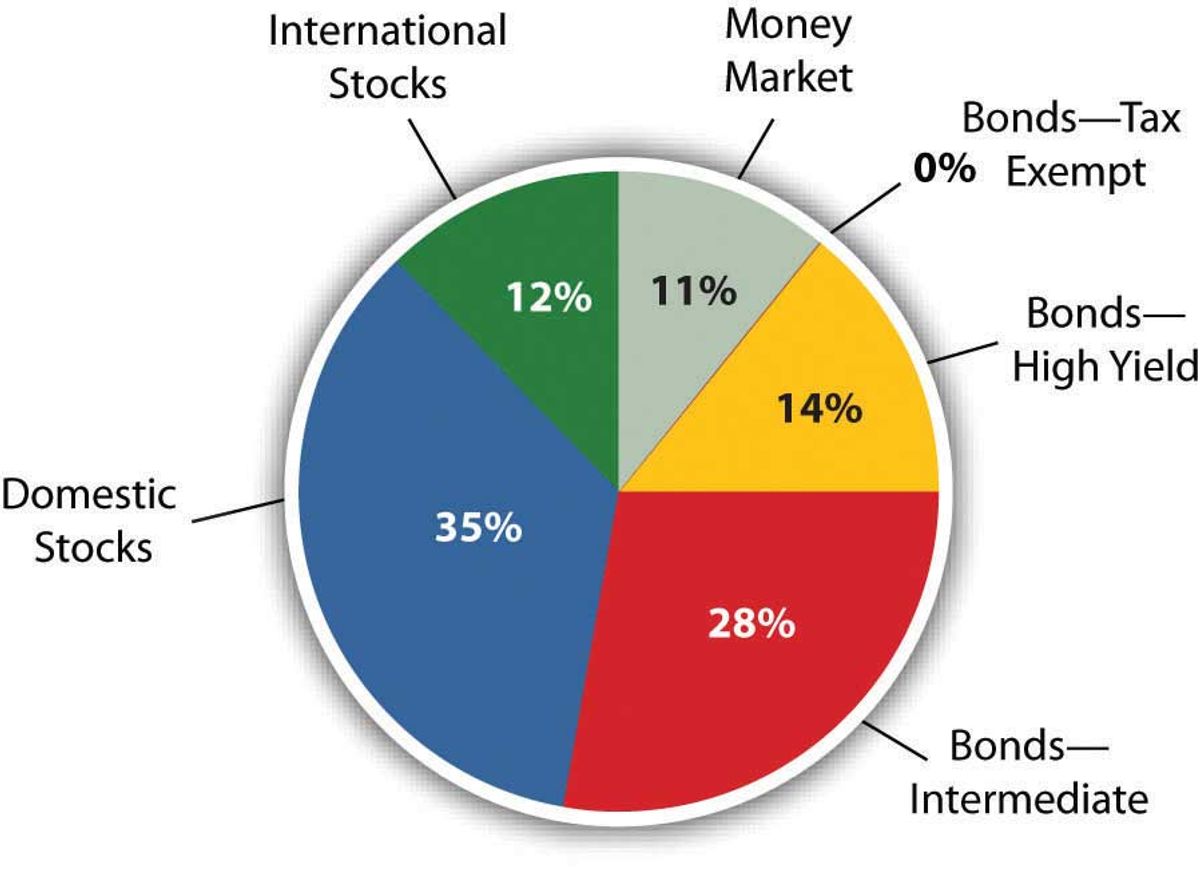

Diversification: Spreading Risk Across the Portfolio

In my journey through the volatile seas of cryptocurrency investing, I’ve learned that diversification is not just a strategy, but a necessity. By spreading my investments across various ICOs and digital assets, I’ve managed to mitigate potential losses and even out the turbulence caused by price fluctuations.

It’s a simple concept: don’t put all your eggs in one basket. Here’s a quick rundown of how I approach diversification in my crypto portfolio:

- Asset Allocation: I categorize my investments based on risk and potential return, assigning a percentage of my portfolio to each category.

- Risk Management: I set stop-loss orders and only invest what I can afford to lose.

- Rebalancing: I regularly adjust my portfolio to maintain my desired asset allocation, taking profits from winners and reinvesting in undervalued assets.

Diversify and manage your crypto portfolio with asset allocation, risk management, rebalancing strategies, and coping with price fluctuations for long-term success in cryptocurrency trading.

While I’ve embraced diversification, I also recognize that it’s not a foolproof shield against losses. The crypto market is unpredictable, and even a well-diversified portfolio can suffer in a market downturn. However, it’s about playing the long game, and diversification has been a key player in my strategy for sustainable growth.

Security Measures: Safeguarding Your Investment

As I delve deeper into the world of cryptocurrency ICOs, I’ve come to realize that security measures are paramount. The prevalence of cyber threats and hacking incidents is a stark reminder that safeguarding digital assets is not just a recommendation; it’s a necessity. I’ve learned to prioritize security practices such as using reputable cryptocurrency exchanges and implementing two-factor authentication.

To ensure the safety of my investments, I’ve adopted a ‘trust but verify’ approach. Utilizing hardware wallets or offline storage solutions like Ledger or Trezor has significantly reduced my risk of cyber theft. Moreover, I remain vigilant and well-informed by staying updated on industry best practices and following trusted sources.

Knowledge remains the best defense against scams. Staying abreast of the latest scam tactics and trends in the cryptocurrency space is essential for safeguarding investments.

Here’s a quick checklist I always run through before making any ICO investment:

- Utilize hardware wallets for secure storage

- Enable two-factor authentication (2FA)

- Verify the legitimacy of the project or platform

- Assess the platform’s commitment to security (e.g., cold storage of assets)

- Stay informed about emerging threats and industry updates

Understanding the ICO Ecosystem

The Role of Community and Communication

In my journey through the ever-evolving landscape of cryptocurrency ICOs, I’ve come to realize that the heartbeat of any project lies within its community. A crypto community is a group of people who share an interest in cryptocurrencies and blockchain technology. These communities are diverse, including crypto enthusiasts, developers, investors, and more. They are the first to rally around a project, offering both support and constructive criticism.

The community’s role extends beyond mere support; it’s a beacon that guides the project through the tumultuous seas of the crypto market.

Social media serves as the megaphone for ICOs, amplifying their message across the globe. Platforms like Twitter, Reddit, and Telegram are not just tools for communication—they’re arenas where trust is built and sustained. Here’s how a robust community engagement can impact an ICO:

- Community Trust: A strong community reflects the project’s credibility.

- Visibility: Active social media presence boosts awareness.

- Feedback Loop: Direct communication with the community provides valuable insights.

- Support Network: A passionate community can drive a project’s success.

Ultimately, the fusion of a supportive community with strategic social media engagement forms the backbone of any ICO’s success story. Together, they create a dynamic environment where projects can flourish, supported by a base of enthusiastic backers ready to propel them into the crypto stratosphere.

Regulatory Landscape: Navigating Compliance

As I delve deeper into the world of ICOs, I’ve come to realize that regulatory compliance is crucial for legitimacy. In regions where cryptocurrencies are regulated, ICOs must meet certain legal standards. The absence of compliance is a major concern, and I always look for platforms that prioritize adherence to these laws, adding a layer of trust and security.

Regulations in the crypto sphere are constantly evolving, with governments and regulatory bodies updating policies to keep pace with the digital asset boom. For the long-term sustainability and acceptance of cryptocurrencies, staying compliant is not just important, it’s essential.

Here’s a quick checklist I use to navigate the regulatory landscape:

- Ensure the ICO complies with laws and regulations in both the project’s and my own jurisdiction.

- Stay informed about the latest regulatory updates and changes.

- Verify the project’s commitment to anti-money laundering (AML) and know your customer (KYC) guidelines.

Balancing innovation with regulation is the key to the viability of cryptocurrencies. As an investor, it’s my responsibility to understand and respect this balance to protect my investments and support the growth of legitimate projects.

Technological Innovations and Their Impact on ICOs

The landscape of Initial Coin Offerings (ICOs) is continually reshaped by technological innovations. These advancements are not just altering the way we approach ICOs, but also how we perceive the potential and risks associated with them. Blockchain technology, for instance, has been a game-changer, enhancing transparency and trust in transactions.

- Blockchain technology revolutionizes cryptocurrency marketing by enhancing transparency, efficiency, and trust.

- Direct transactions and smart contracts are now at the forefront, streamlining processes that were once cumbersome.

- Innovative techniques are being developed to optimize user experience, though they present new challenges, such as regulatory compliance.

The integration of these technologies into the ICO framework is a double-edged sword. While they offer a plethora of benefits, they also introduce complexities that must be navigated with care.

As we move forward, it’s crucial to keep an eye on how these technologies will continue to evolve and influence the ICO ecosystem. The promise of a more efficient and secure investment environment is tantalizing, but it comes with the need for increased vigilance and understanding of the new tools at our disposal.

Investor’s Guide to ICO Success

Assessing the ICO Platform and Team Credibility

When I consider diving into a new ICO, the first thing I scrutinize is the platform’s reputation and the team’s credibility. Platforms with a history of launching successful projects are more likely to attract quality ICOs, which is a reassuring sign for potential investors like myself. User reviews and transparent feedback systems are also indicative of a platform’s trustworthiness.

Here’s a quick checklist I follow to evaluate an ICO platform and its team:

- Research the team’s experience and credibility in the cryptocurrency industry.

- Check the project’s community and social media presence for signs of active engagement.

- Investigate any legal issues or past failures associated with the team.

- Analyze the project’s whitepaper for clarity and feasibility.

- Look for strategic partnerships and assess market potential.

- Stay informed about the latest market news and updates.

In essence, the right ICO platform will offer a blend of regulatory compliance, a solid reputation, community engagement, stringent security measures, and clear plans for liquidity and transparency.

Navigating the altcoin market requires thorough research, due diligence, and understanding of market dynamics. Diversification and long-term viability assessment are key for successful investments in altcoins.

Strategic Presale Advantages

The allure of crypto presales lies in their ability to offer tokens at a fraction of their potential market value. This early access is not just about getting a better price; it’s a strategic move that can set the stage for substantial gains. By investing in a project during its presale, I position myself ahead of the general market, gaining an edge over those who wait for the token to be publicly traded.

- Strategic crypto trading on major platforms like Binance, Coinbase, and Robinhood.

- Each platform offers unique features and fee structures.

- Emphasizing diversification for long-term growth.

The key to leveraging presale advantages is to remain vigilant and proactive. It’s about more than just buying in early; it’s about understanding the project’s vision and potential. A presale is a commitment to a project’s future, and as such, it demands thorough research and a belief in the project’s success.

Indeed, the journey from presale to public trading is fraught with uncertainty, but the rewards can be significant. It’s a path that requires a blend of optimism and strategic planning. By staying informed and selective, I aim to capture the upside of these early investment opportunities while being mindful of the risks.

Staying Informed: The Importance of Market News and Updates

In the dynamic realm of cryptocurrency ICOs, staying informed is tantamount to navigating a ship through treacherous waters. The landscape changes rapidly, and what was true yesterday may not hold today. To keep a pulse on the market, I regularly consult a variety of sources. CoinMarketCap and Twitter are staples in my routine, offering a broad view of market sentiment and ICO buzz.

It’s not just about having information; it’s about understanding and acting on it in a timely manner.

I also make it a point to delve into the more granular details of each ICO. This includes a thorough review of the project’s whitepaper, roadmap, and the team’s track record. Here’s a simple checklist I follow:

- Review the ICO’s whitepaper for vision and feasibility

- Check the roadmap for clear milestones and timelines

- Assess the team’s transparency and past achievements

By keeping abreast of both the macro and micro aspects of the market, I can make more informed decisions that align with my investment strategy. Regular market analysis and portfolio rebalancing are key components of this strategy, ensuring that I’m not just riding the waves of hype, but making calculated moves based on solid data and trends.

Conclusion

In conclusion, cryptocurrency ICOs offer a dual-edged sword of high-risk and high-reward opportunities. They have revolutionized the way new projects secure funding and have provided investors with the chance to be part of potentially groundbreaking ventures. However, the volatile nature of the market, regulatory uncertainties, and the prevalence of scams underscore the need for meticulous research and prudent investment strategies. Investors must weigh their appetite for risk against the lure of early-stage investment gains and proceed with caution. As the ICO landscape continues to evolve, staying informed and vigilant is paramount for those looking to invest in the future of digital finance.

Frequently Asked Questions

What are the main advantages of participating in cryptocurrency ICOs early?

Early participation in ICOs can provide access to initial token prices that are often lower than post-ICO market prices, potential bonuses or incentives, and the opportunity to support and influence emerging projects in their infancy.

What are the most significant risks associated with investing in ICOs?

The risks include potential for scams and fraud, regulatory uncertainty, extreme market volatility, and the possibility of total loss of investment due to the speculative nature of many projects.

How can investors protect themselves when investing in ICOs?

Investors can protect themselves by conducting thorough research, understanding the project’s whitepaper, evaluating the credibility of the team, diversifying their investment portfolio, and staying informed about market news and updates.

What role does due diligence play in ICO investing?

Due diligence is crucial in assessing the viability and credibility of an ICO. It involves scrutinizing the project’s business model, technology, market potential, team expertise, and legal compliance, which helps in making informed investment decisions.

How does market volatility affect ICO investments?

Market volatility can lead to significant price fluctuations of tokens acquired through ICOs, which can result in high gains or severe losses. Investors should be prepared for the possibility of sudden market changes.

What should investors look for in an ICO’s whitepaper?

An ICO’s whitepaper should provide detailed information about the project’s concept, technology, tokenomics, roadmap, team background, and how the funds raised will be used. It should be clear, comprehensive, and realistic.

RELATED POSTS

View all